One Year Business Update

It’s been 12 months since my wife and I started our commercial cleaning business. It officially opened on June 1st, 2018. I did a mid-year update and I’m excited to give you an idea where we are at the one-year mark.

For those who are new to the blog, my wife and I were living near Seattle, WA earning around $200,000 a year combined. Seattle has a very high cost of living. We lived small, in a 580-sf apartment so that my wife could walk to work, and I worked from home. Living in the city of my wife’s work was expensive but avoiding a 4-hour roundtrip daily commute was worth it. After reading several financial independence books and late-night discussions, we decided to quit our corporate jobs and start our own businesses. Our hope is that it would catapult us faster towards financial independence than living small in an expensive city. That is the grand experiment we are living.

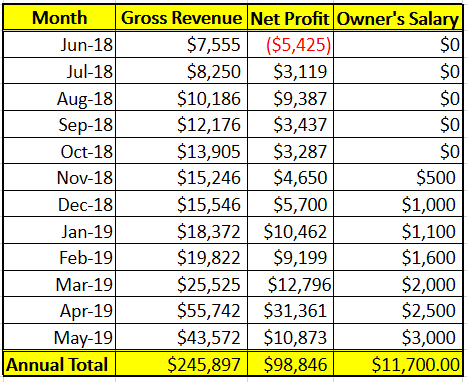

Now for the update. Here are our numbers:

We are building cash in our company account and clearing debts owed to the owners (we’re getting our start up money back!).

As you can see, starting a business is not an instant path to wealth. There are usually delayed pay days, long hours, and stresses beyond a normal 9-5 job. One of my recommendations to anyone thinking of starting a business from scratch, is to be ready to not take a salary for a year. Also have enough working capital (cash in the company bank account, not yours) to fund at least 3 months of all expenses in your business.

Side note: I keep track of everything through QuickBooks Online. It’s a life saver! So if you are thinking about starting a business, being self employed or just need to better track your numbers, check them out. They’ve made it easy for me, and I can’t recommend them enough. They are offering a special deal to ATG readers. Click on the QuickBooks image for more details.

Back to the story. I have been taking a small salary for now, and using the remaining cash to buy equipment, pay off debt owed to myself and my wife and to build a cash buffer in our business checking account for the unavoidable months where cash becomes scarce. It’s been exciting to increase our salary each month and to get fat checks reimbursing us for our initial start up funds. We are starting to see progress and it’s very encouraging.

Things we have learned this first year:

-It’s ok to turn down work:

We’ve found ourselves accepting every job that came along. However, these $125-$400 a month accounts took almost as much energy and time to manage as the $6,000 a month account. We fired our first customer on Friday; a $307 a month account. As the other smaller accounts drop off, we will not try and replace them.

-You need to target your preferred customers:

This is related to the above comment, but if you want customers that are 5 days a week, for example, and not once a week, then turn down the leads that don’t fit your customer profile. If we had done this after the half way point, I’d have fewer grey hairs. It’s important to remember to create the business you want. Keeping your sanity is paramount!

-Hiring good people is extremely difficult:

I think my previous posts on “Ghosting” have explained some of my pain, but also each staff member has their own personality. If you have ever been a parent or helped with children at all, you’ll understand that each child needs to be treated uniquely when it comes to teaching, coaching and discipline. Your staff feel like family. You want to see them succeed! Their success is your success. But you can’t force anyone to take on success. You can only give them the opportunity. Sadly, many don’t take it. I’ve had to fire 7 employees in the 12 months I’ve been in business. I’ve had a total of 28 employees on my payroll but only have 16 active employees now. There is a lot of turnover in this business. Just like the customers, if the employee doesn’t fit your culture or standards, then it’s best to invite them to leave and find a job that better fits their capabilities.

-Self-employment is not for everyone:

Finding time to get away from the business during the first year is hard, but we found our way to San Diego in May.

My wife has expressed to me that if I wasn’t around, she probably would have never started her own business, let alone a cleaning business with lots of employees. I would have never started this business either if it weren’t for the fact that I had my wife on my side helping. Before jumping into self-employment, take a long look in the mirror and make sure you are ready emotionally, financially and physically. If you can, find a strong person who can help you along the way. That could be a spouse, other family member, or key employee. You can’t be good at everything. I’ve found that running your own business, especially with employees, will make you painfully aware of your weaknesses. Find someone who can be strong where you are weak. I’m good at the books, production and human resources. Jessica (my wife) is good at sales, product ordering, confrontation, software/hardware, equipment management/repairs and has a steady head. I get distracted easily and she pulls me back down to reality to keep me focused and moving forward. Know yourself and prepare for your weaknesses in your business planning.

It’s been a wild ride so far. Below is a picture of our revenue goal tracker we have on our wall. I need to have a visual display when working on a goal. By April we crossed over our annual monthly revenue goal. $20,000 of that was a one-time project, so we are still working on building to our annual goal of $42,000 a month of reoccurring revenue. We are very close to doing so. It’s fun to see us hit a goal that we honestly thought was unachievable when we set it. We not only hit it but did it 8 months earlier that we thought we would. This is what running your own business is all about; hard work, but the spoils are yours!

My personal upside down goal tracker on my wall. April was a really fun month of filling in boxes. June is not complete yet. We are hoping to match May.