Is Saving 10% Enough?

I have to admit, it’s been a crazy few months here at ATG Financials. I’m running a small janitorial business and it’s been super busy with the Covid-19 outbreak. Believe it or not, cleaning and disinfecting is in high demand right now. Below is a member of my team disinfecting a restaurant so that it could open the next day.

Disinfecting businesses to keep them open during Covid-19.

I’ve had a lot of drive time and realized that I don’t think I’ve ever drilled down to the nitty gritty on how much my wife and I spend and save each month. I found a young woman on Instagram who posts her spending and saving each month. It helps inspire me to do better and to get ideas on how to manage my finances. If you are interested, check out mywealthdiary on Instagram. This young woman is a rock star! She is starting her financial independence journey young. I find myself living vicariously through her as I wish I had started much younger than I did with my Financial Independence goals.

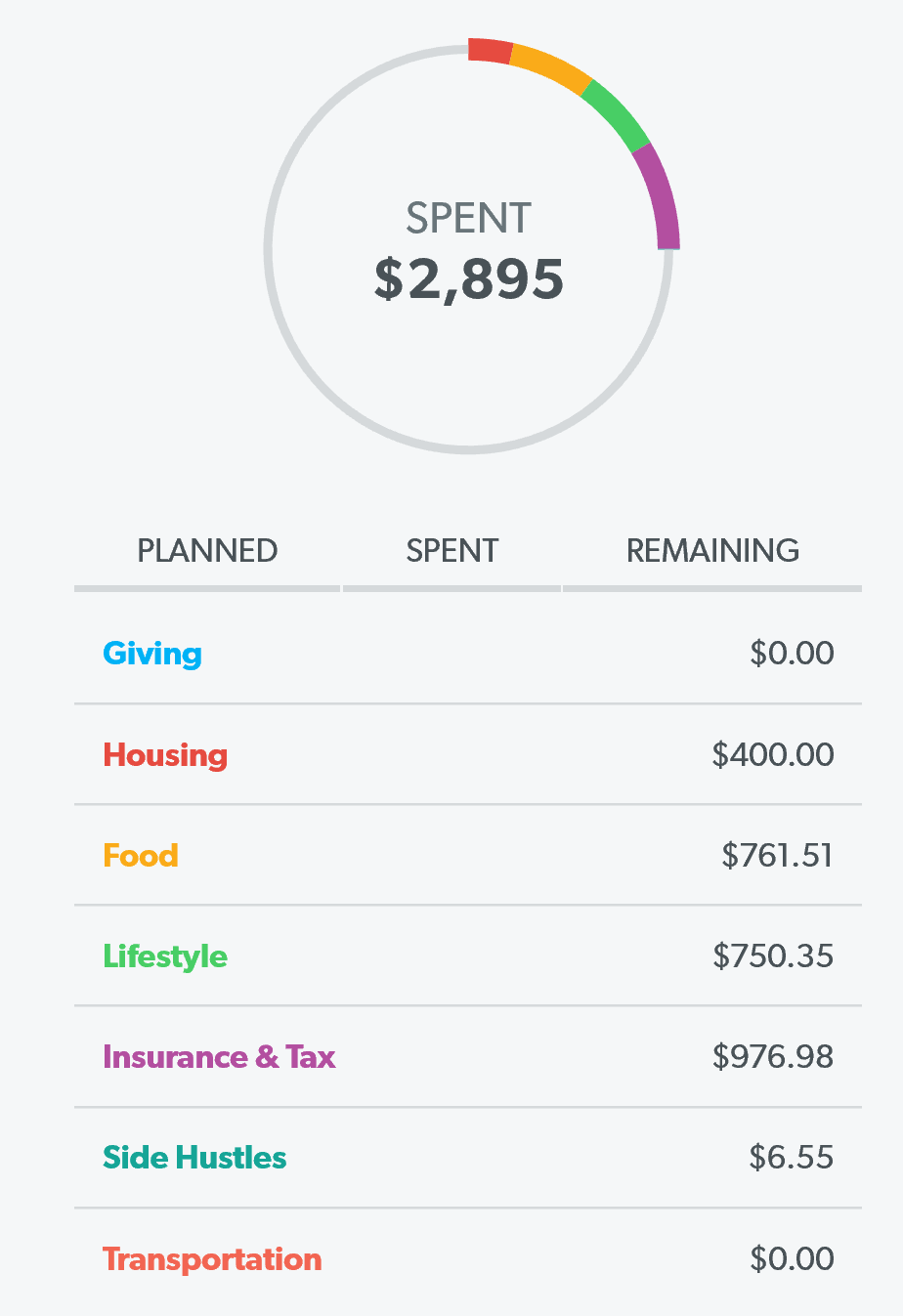

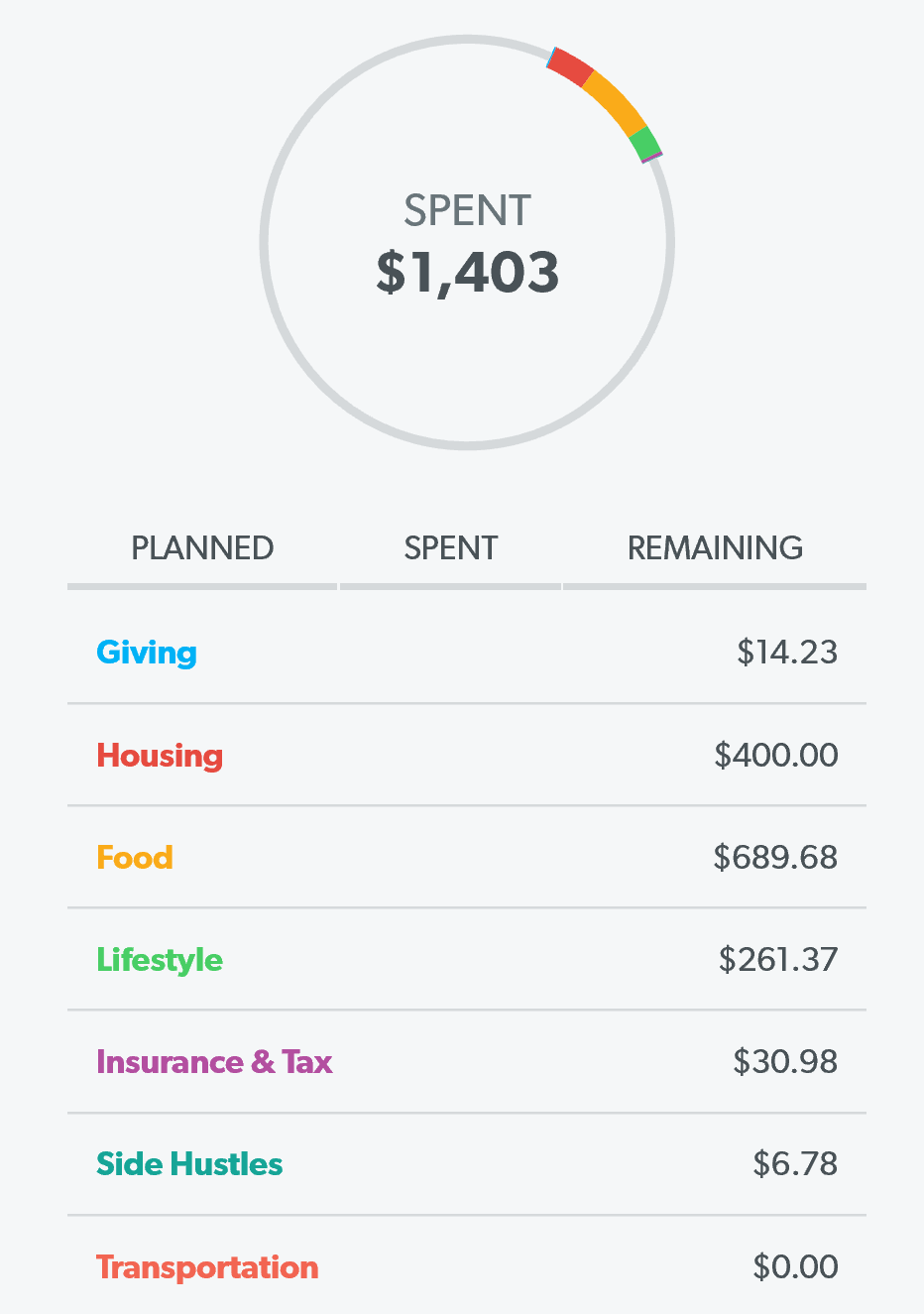

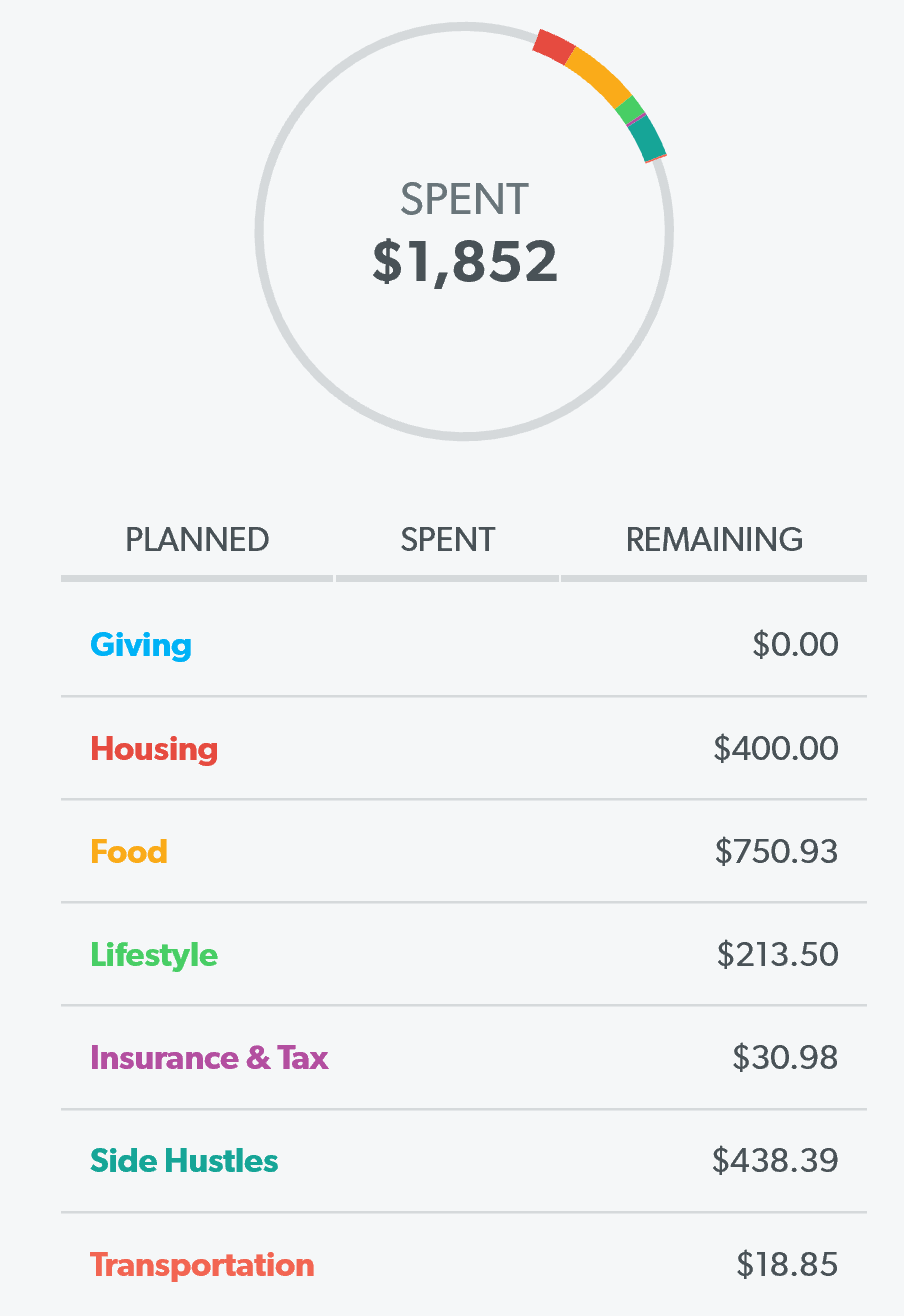

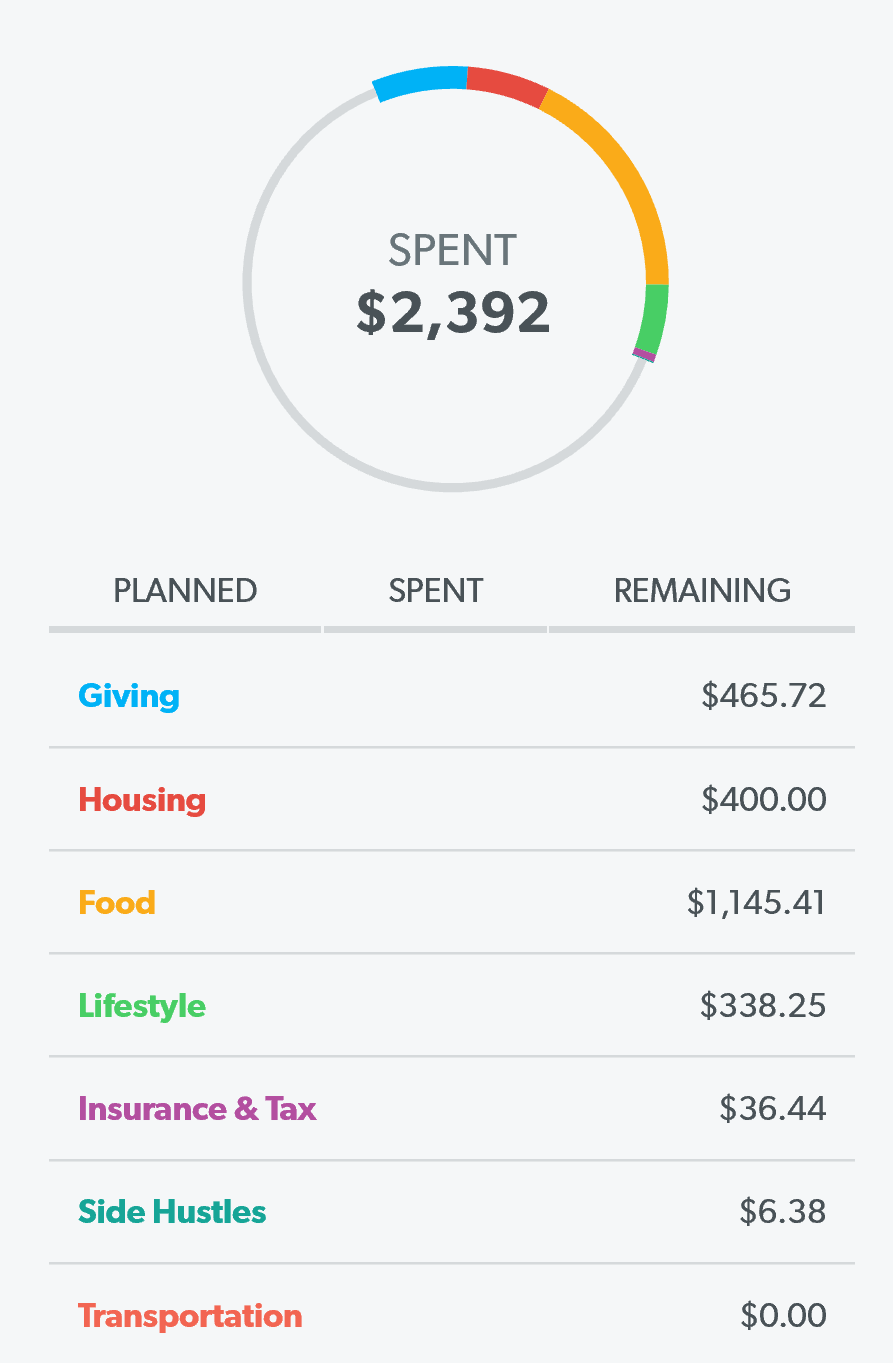

Anyways, below you can find our spending and saving for 2020 YTD.

January through April 2020 Spending Summaries

YTD Spending 2020

What % of your income are you spending?

YTD 2020 Spending

I find that no month is ever exactly the same.

As you can see, my spending has ranged from 12% to 37% of my income. Some of the larger months are due to quarterly tax payments being due (I am self employed) as well as ordering half a pig or cow from my local farmer. It’s a big expense for my wife and I but we value pastured raised local meats. So it’s worth it to us to spend extra to make sure that the meat we eat is healthy and had a good life on pasture.

Below you can see what I’m really focused on, which is my savings rate. Because my wife and I are self employed, we don’t have a steady income each month. We have multiple side hustles on top of our cleaning company’s income. I spent years thinking that saving 10% of your income was normal and safe. I finally read a book that explained how women are more vulnerable to income disruption due to our roles in society, and so the book recommended that women save 15%. So I started to save 15%. At that rate, I would not be financially free until my 60’s! Being financially free means being able to work on what I want to work on. To not have to go into a job that I hate everyday or have to beg for a week off of work each year for vacation. I can help family when they need it or strangers through scholarship funds and other outlets. If I’m a slave to a job until my 60’s because I can’t go without an income for more than a month or so, what kind of life would I be living? My wife and I have had these discussions on many occasions. We are laser focused on not being a burden to our family when we get older, on actually being someone they can go to in times of need. Our parents were not taught the power of Financial Independence and so they were rarely resources in our adult years when times were tough for us. We didn’t want to repeat that cycle. In order for my wife and I to be free of “having” to make money, we need to save north of 50% of our income each month. When we looked at what we really valued, it slimmed down our spending. We are focused on time together, exercise, healthy eating and helping family. That is where our money goes. It doesn’t go to Starbucks, Target, Amazon, hair salons, clothing shops, etc. Because we don’t value those things. We purchase what we need, and then focus on what we value. My wife and I sat down one night and wrote out what makes us happy. Everything on that list did not cost money except healthy food. And to mitigate that spending, we are working toward living on a farm to provide as much of our food as possible from our own property.

Managing my money has become a spiritual journey of sorts. I hope that by sharing what my wife and I are working on, that it triggers some ideas in your mind with how you want to spend your money, and in reality time on this earth. Money is TIME. You give your life energy for money. When you spend money, you are giving chunks of your life away to someone else. Stop and think before mindlessly spending and ask yourself, is this item worth the life force/time to produce the money to pay for it?

OK, below gets into the good stuff. Our savings rate. Try not to focus on the dollar amount. Each of us are coming from different income levels in life. The true focus should be on the % savings rate. That is your true vehicle to reach freedom from having to work for money.

YTD Savings 2020

I was always taught to save 10%……Why so little?

YTD Savings 2020

Tracking helps keep me motivated